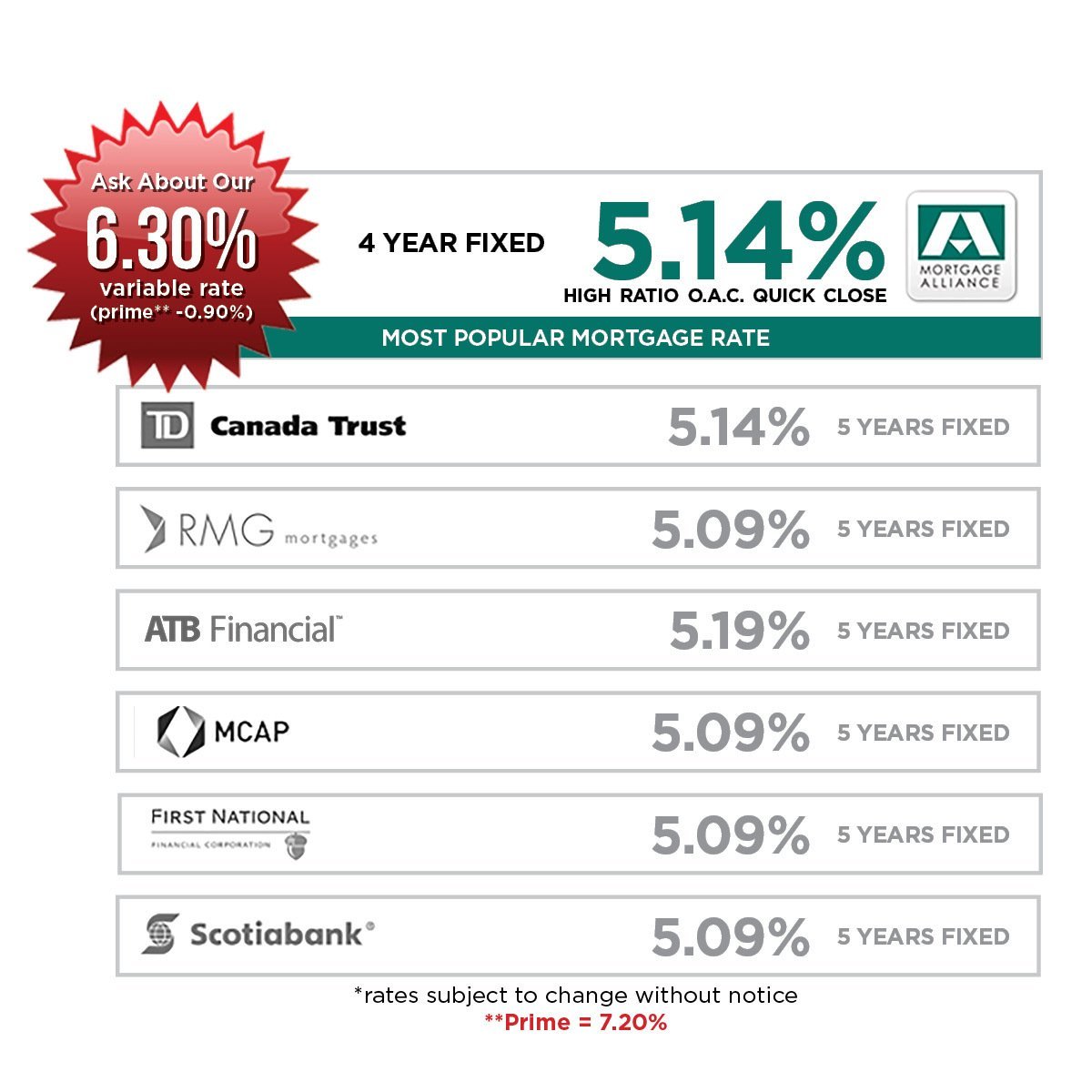

The Best Mortgage Rates in Calgary & Edmonton

Get in touch!

Why the lowest mortgage rates are not always the best mortgages in Alberta - What's the difference? It all depends on your situation, your goals and your risk tolerance. This is part of my job to ask you when we place your mortgage. Buyers who focus solely on the lowest rate typically end up with a "costly stripped down" mortgage, which may not be the best for your situation or your goals for your new home. Consider more than just the rate when shopping for your home financing.

Here are some things to think about:

- Mortgage Interest Rate - The lowest vs the best

- Prepayment Privileges - Helping you save money

- Portability- Moving your mortgage with you

- Rate holds and length of term - Capitalizing on SMART financing

- Costly Pay-out penalties - The kicker of the "lowest rate" teaser

- The varying methods used to calculate payout penalties when you break your mortgage - Making a bad deal sound good

- The length of time you plan to stay in this home - Tailoring your financing to you

We work with the best mortgage brokers in Calgary to help you navigate this complicated and potentially costly transaction. They will help you with more than just the lowest mortgage rate. They will help you attain the best mortgage terms with the most appropriate rate based on YOUR unique profile. Just fill out the form above and we will make it as easy as we can.

Quickly Calculate Your Monthly Payment Amount

This mortgage calculator can be used to figure out monthly payments of a home mortgage loan, based on the home's sale price, the term of the loan desired, buyer's down payment percentage, and the loan's interest rate.

Contact Diana Dorais

source: tradingeconomics.com